As the Cambodian Government prepares, for the first time, to approve its emergency draft law, allowing Prime Minister Hun Sen to declare, if needed, a state of emergency across the Kingdom in response to the unfolding global COVID-19 pandemic.

For the latest Cambodian Business news, visit Khmer Times Business

He stated this week: “I have been in power for 27 years since 1993 and I never thought I will have to use this kind of law. Now the situation in the country and countries around the world is bad because no country on earth could stop COVID-19.”

Policymakers are now having to switch their thinking from just implementing preventive COVID-19 health measures to also developing proactive economic measures that can last the potentially months-long lockdowns and extreme social distancing, measures that will, without doubt, cause havoc on not just Cambodia’s economy but also throughout the region and globe.

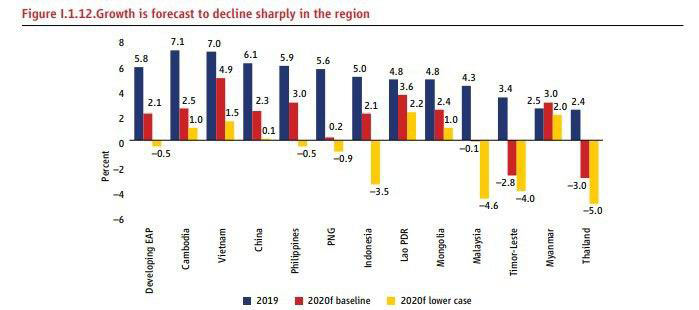

Predictions backed by a World Bank report released this week titled “East Asia and Pacific: Countries Must Act Now to Mitigate Economic Shock of COVID-19”, states Cambodia’s economic growth is expected to crash from 7 percent growth in 2019 to a predicted 2.5 percent on current baseline modelling or drop further to 1 percent on low line modelling this year before returning to a predicted growth recovery of 5.9 percent in 2021.

A Kingdom built on SMEs

However, while this is good news for next year, many are asking what will become of the Kingdom’s small and medium enterprises (SMEs) over the coming year. As the majority of these businesses are family run and operate finances month to month and do not have access to the large amounts of reserve capital like large corporations. SMEs are businesses that are considered both the economic and societal backbone of the nation and need to still be standing when the COVID-19 pandemic is eventually resolved and life returns to normal.

SMEs are defined in Cambodia as any enterprise with between 10 to 100 employees and from $62,500 to under $1 million in turnover, a definition that encompasses the overwhelming majority of Cambodian businesses and the backbone of most emerging economies, with Cambodia no exception. Representing commercial traders, manufacturers, agriculture and the service industry – all businesses that dependent on open borders and a spending local and global economy. A sector according to the Ministry of Industry, Science, Technology and Innovation (formerly the Ministry of Industry and Handicraft), is vital to achieving the government’s ambition to attain upper-middle income status by 2030 and high income by 2050.

With the ministry estimating that of the 510,000 business in Cambodia last year, more than 90 per cent of them were SMEs contributing 32 percent to the country’s gross domestic product and employing 1.2 million people in the sector. Although, according to the ministry, only 5 percent of these businesses are formally registered, meaning the overwhelming proportion of SMEs operate within what is known as the “informal economy”.

National response to pandemic

As like many other nations around the world at this time the Cambodian government has been discussing ways it can assist the Kingdom’s businesses and their employees to get through this period. In early March, Prime Minister Hun Sen announced he had allocated between $800 million to $2 billion to address the economic impacts of COVID-19, stating the lower end of the allocation would help deal with the economic slowdown over the next six months, while the $2 billion has been reserved if the outbreak lasts more than one year. “The government has allocated funds based on two scenarios of COVID-19,” Mr Hun Sen said. “There will be an $800 million package for a period of six months and a $2 billion package if the outbreak lasts a year and longer,” he added.

If we go on the assumption that this pandemic will last the remaining of 2020 and require the full $2 billion allocated, then relatively speaking for a nation with a population of about 16 million and an economy with a gross domestic product (GDP) of around $22 billion, the Cambodian Government’s COVID-19 stimulus package is at an approximate 10 percent ratio of stimulus to GDP. This is a ratio on par with other big sending Western nations like the United Kingdom (15 percent), the United States of America (10 percent), and Australia (9 percent), while far exceeding regional neighbours Thailand (3 percent) and the Philippines (1 percent).

However, while Cambodia’s stimulus package numbers do look good on paper, the devil is always in the detail, and understanding how these funds will be distributed may reveal a different story. While there is currently no set directive, it appears that the majority of these funds will be administered in the form of tax cuts and loan exemptions, not through hard cash payments to individual citizens who have lost income because of redundancies or reduced workloads, which has been the norm for many stimulus packages around the world.

A formal package

This method of fund distribution is the fundamental problem for the previously mentioned 95 percent of SMEs that are unregistered and operate in the informal economy – fundamentally these business are not on the tax roll, essentially making any tax cuts redundant and rendering them eligible for any potential government grants, while still being hurt by the fact that borders are closed, citizens have lost jobs, people have reduced spending and all the tourists are trying to get home.

Capital Cambodia raised this scenario with the spokesperson for the Ministry of Economy and Finance Meas Soksensan, who bluntly stated, the stimulus package announced by Prime Minister Hun Sen last month will only be given to those businesses that are legally registered and are formally verified. The spokesperson also openly stated that the stimulus package could be used to further incentivise informal SME owners to formally register for both the benefit of their businesses and employees. He also said that the ministry will need to carefully analyse how each individual business is being affected. “Not all companies will be affected equally, so we will take that into account,” he said, adding that the ministry may also use further tax policies to help struggling businesses for a certain period. This would follow measures already taken to aid the stricken tourist industry.

Opportunity for change

Unregistered SMEs in Cambodia have long been the target for both the Ministry of Economy and Finance and the newly named Ministry of Industry, Science, Technology and Innovation with ministers attempting to implement various initial registration tax exemptions, market information sharing, coaching in technology and technology and priority access to funds.

That includes access to the $100 million dedicated SME Bank that is due to open in the second half of 2020. Owned by the Royal Government and operated by the Ministry of Economy and Finance, its main objective is to help SMEs to “flourish”. To do this, it will put extensive programmes in place to educate the operators of SMEs on banking and other financial matters. While also functioning to promote the creation of new startups in the country in four main sectors: agriculture, manufacturing, tourism and digital startups for both domestic and export markets.

However, as the President of the Federation of Association for Small and Medium-Sized Enterprises of Cambodia (FASMEC) Oknha Te Taing Por has previously said, even with the previous offers he believes businesses still lack genuine incentives and enforcement for the low level of tax compliance, stating a lot of businesses face registrations challenges while at the same time as they struggle to compete to be profitable,” he said.

He added tax enforcement is not balanced and transparent in the SME field and there is no benefit for SMEs to register because they are not protected from neighbouring competition.

He reiterated an age-old problem with large taxation systems that unless the overwhelming majority is registered and paying taxes, with heavy and transparent penalties for those that are not – then nobody is. That said, over the coming months, the Cambodian economy is predicted to slip further and further into the economic crisis. This could prove to be the catalyst for businesses to essentially be forced to register to gain access to vital grants and, in turn, possibly flipping the 95 percent of SMEs to register.

There will be a valid debate on both sides of the argument for using this COVID-19 stimulus package to pressure unregistered businesses to enter the formal economy. While there is no doubt that all business and individuals should pay their fair share of tax, the ministry will need to be careful that not providing any help to the overwhelming majority of business currently operating informally may result in the sector simply shutting down and taking along both the nation’s largest employers and fabric of Cambodian society with them.