In a working paper released recently, the International Monetary Fund (IMF) calls upon Cambodia to address the rising inequality that plagues the nation.

For the latest Cambodian Business news, visit Khmer Times Business

This, the IMF suggests, could be done most effectively by the reformation of property tax.

The paper recognises and praises the efforts in poverty reduction that have seen consumption inequality fall to 29 percent in 2012 from 40.4 percent in 1997, according to the Standardised World Income Inequality Database and notes this is below the ASEAN average.

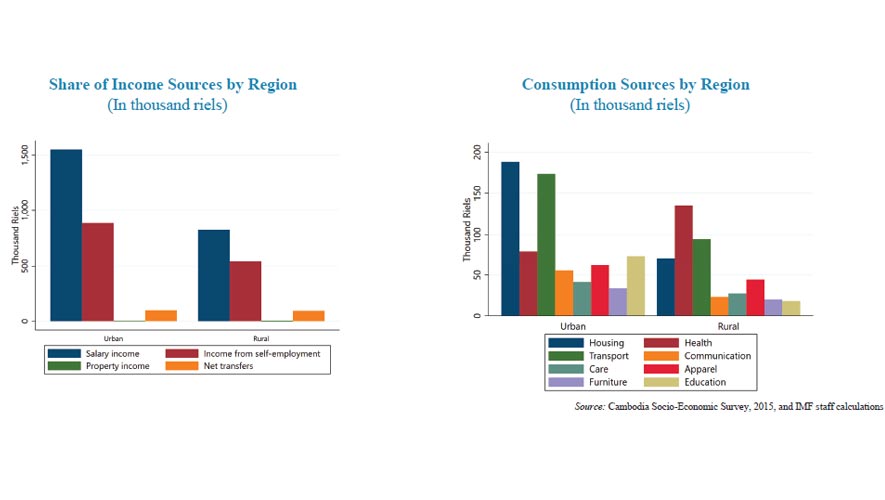

“From 2012 to 2015 the inequality in consumption appears to have been broadly unchanged, while the inequality in income has risen somewhat,” the report reads, citing rural to urban migration as one possible factor.

However, more needs to be done to address the gap between rural and urban standards of living, with the IMF highlighting the fact that 80 percent of the population reside in rural areas, but their average household income is only 60 percent of the average urban household income.

Infrastructure was highlighted as the key area for development to help boost rural household income by providing greater mobility and market access.

Just 10.5 percent of all roads in Cambodia are paved, which is well below the average rate seen across ASEAN.

“The share of the population with access to safe drinking water, basic sanitation services and electricity also remains relatively low,” says the report, which goes on to detail empirical evidence that inclusive growth is reliant on quality infrastructure in rural areas of the nation.

Financing the much-needed development of critical infrastructure in rural areas would be most successfully accomplished through reformation of property taxation policies, the IMF argues.

In its assessment of government policies with a distributional impact, the IMF warns that Cambodian tax policies rely heavily on non-progressive taxes – in which tax rates do not increase in line with the increase of taxable goods and services.

“On the other hand, revenue in Cambodia relies relatively little on progressive income sources such as the personal income tax (PIT), income and capital gains, or property taxation,” says the IMF.

It draws attention to property tax, which accounts for just 0.1 percent of gross domestic product (GDP) – a distinctly low level for the region that only seems smaller when compared with value-added tax, which accounts for 17 percent of GDP and 61 percent of total tax revenue.

The authors of the working paper, Niels-Jakob Harbo Hansen and Albe Gjonbalaj, conclude that the most significant impact on tackling inequality is through reforming property tax. This, they argue, will also generate the largest positive effect on GDP.

“The positive effect on inequality from the property taxation stems from the fact that Cambodian households with higher incomes tend to pay a larger share of their total income in property taxation,” the paper reads.

“Inequality also falls, albeit by less, when higher revenue is attained from higher labour market taxation.

“On the other hand, inequality tends to rise when a higher VAT is used to generate additional revenue.”