I write this piece having just witnessed, like all of you, the fastest bear market in history. A bear market is a decline of 20 percent or more over a sustained period and is certainly not the type of record anybody is keen to see get broken. The chart below highlights just how unprecedented the COVID-19 crash has been, taking just 16 days to reach bear-market status. When you compare 16 days with the 188 days it took to reach a bear market during the 2007-08 global financial crisis, this truly highlights the magnitude of where the world and the markets find themselves today. More worryingly we aren’t even through the worst of COVID-19.

For the latest Cambodian Business news, visit Khmer Times Business

With most markets falling 30 percent from their recent peak, you will have no doubt started hearing the term “RECESSION”. Many clients have asked me recently why we aren’t already in a recession given the huge decline and quite simply it is because a recession is defined by a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters. Take no positive from this decline not yet being classified as a recession because it is only the “two successive quarters” that we are missing.

We can, however, take a number of positives from a market and investment perspective, as Albert Einstein once said, “In the midst of every crisis, lies great opportunity.” As many of my clients will have witnessed this last month, I have been available to them and working seven days a week and most evenings past 10pm. The reason is, success and growth, only occurs when opportunity meets preparation. It is absolutely paramount that all of us to prepare for the recovery and what is the one of the best market opportunities in over a decade.

When will the market bottom out?

During market declines, this is the single most common question I get asked and I am always truthful: Nobody has a clue. This is even more true today because we have no idea how long it will take the world to win the battle against COVID-19. My view is that only when the COVID-19 infection rate peaks, will the markets begin their road to recovery. The most important thing to remember is that we don’t need to catch the bottom of the market to make a healthy return through the recovery.

Will a rally mark the start of recovery?

Despite the Dow Jones on Tuesday March 24th recording its largest one day gain since 1933, I feel strongly that this isn’t the start of the recovery. With many countries just starting a 30-plus day lockdown and the infection rates still soaring, I believe this mini rally is what the industry calls a Dead Cat Bounce, which is a temporary recovery from a prolonged decline or a bear market that is followed by the continuation of the downtrend. In short I still feel it is a touch premature to be adopting an aggressive equity position but the moment could be nearing to begin a phased entry into equities

When should I buy equities?

This for me is the most important question over the coming days and weeks. I will be contacting all clients in early April to outline the strategy for allocation to equity growth from cash and defensive holdings. WHEN we apply this strategy, depends on the numbers (infection rate) relating to COVID-19.

What and how should I buy?

Given the market low, for most clients a simple exchange traded fund that tracks a major index such as the S&P 500 will be low cost, low maintenance and more than adequate. This will just track the recovery of the market with no complex investment strategy and no additional fund management fees.

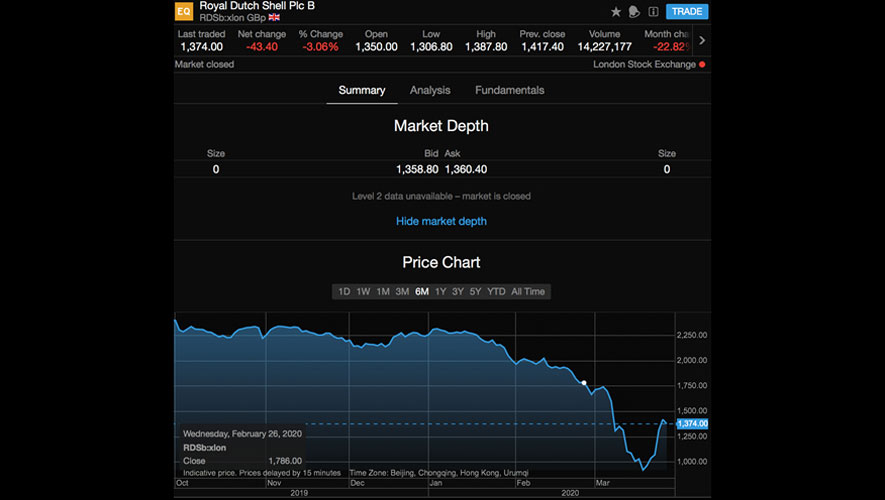

There is also the option to buy direct stocks. With many clients wanting a balance between growth and income (dividends) we find ourselves with strong dividend paying stocks such as BP and Shell (both with dividends above 10 percent) now at a 35-45 percent discount from their January levels.

That said many clients will want a more actively managed professional approach to this buying opportunity, such as an equity growth fund that holds and trades a portfolio of growth stocks. Rather than client and broker selecting stocks this strategy employs the world’s leading fund managers and banks to utilise their teams of analysts, researches and investment professionals to make the investment decisions.

With many of my clients retried or nearing retirement they tend to favour structured notes and the protection they offer. These products provide a pre-determined return (usually quarterly or annually) from a large bank with a degree of capital protection. This allows the investor the benefit of participating in the markets but with a greater degree of stability.

Adam Clark is managing partner at 10X Wealth Management