Investors are entering 2019 with wary thoughts after a year of weak performance characterised by extreme bouts of volatility. The S&P 500, considered the bellwether of stock performance, ended 2018 with its biggest yearly loss since the global financial crisis.

For the latest Cambodian Business news, visit Khmer Times Business

Shares have been whiplashed as ramifications of the trade battle between the US and the China reverberated throughout industries ranging from oil to phone manufacturing.

Among South-east Asian stock markets, Cambodian equities outperformed, delivering over 10 percent to investors. With valuations having eased, some analysts say it may be a good time to re-enter the stock market. Among the most popular bets: the US-China trade battle could end up being a boon for South-east Asian nations that manage to attract firms seeking to skirt tariffs by relocating their factories.

An opportunity for Cambodia

This could mark an opportunity for Cambodia’s burgeoning textile industry to gain export market share from China, says Anirban Lahiri, Head of Research at VNDirect Securities Corp. He points to Thanh Cong Textile Garment JSC in neighboring Vietnam that operates a production chain for yarn and garment products, and expects to benefit from the trade war.

Fabric products imported from Vietnam are being levied a 17.5 percent tariff, compared to 25 percent levy on Chinese fabric goods.

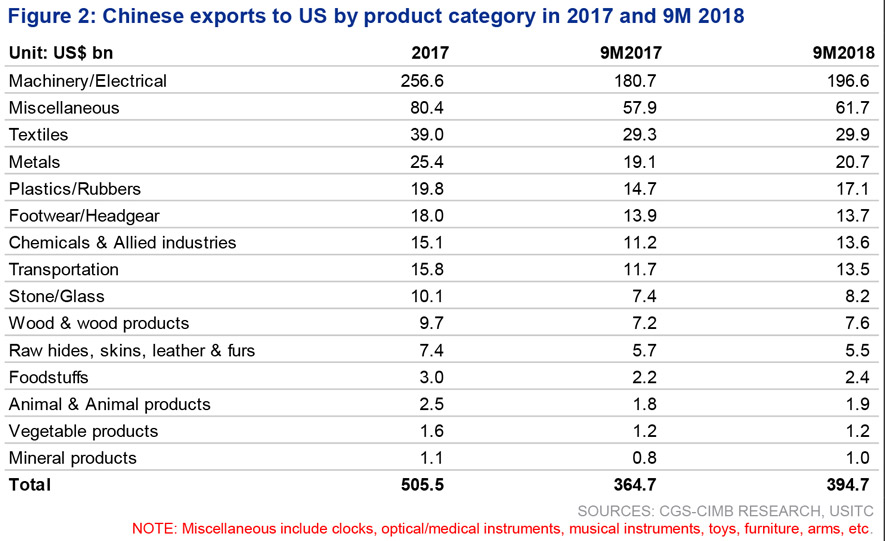

Textiles are the second-largest category of Chinese exports to the US and although largely exempt under current tariffs, “it could see a 10 times increase in tariff coverage in the event of a trade war escalation,” he projects.

“Given Cambodia’s close sovereign relationship with China and easy access to land, it is possible that Chinese factories in other labour intensive sectors such as electronics and parts assembly could move to Cambodia as well,” Anirban tells Capital Cambodia.

“Also, Cambodia is an outsized beneficiary of Chinese capital, so Chinese citizens will likely be keener to move their money and assets out of China in the event of a prolonged trade war. You might see more Chinese money flowing into property and tourism assets here. As Cambodia is a low cost destination for Chinese tourists, I don’t see tourist arrivals falling off a cliff unless the Chinese economy slows dramatically due to the trade war,” Anirban says.

Regional bets

Elsewhere, the US-China trade dispute has “created a unique opportunity” for Malaysia due to the nation’s perceived position as a safe haven for manufacturing investors, says CLSA analyst Sue Lin Lim.

Investors should keep watch on foreign direct investments and private investment flows in Malaysia – with a focus on the states of Penang and Johor, home to industrial clusters, Lim says.

“In addition, the Industry 4.0 blueprint aims to make Malaysia the prime destination for high-tech industries, including the development of an aerospace-industry hub,” he adds. CapCam